Managing debt can feel overwhelming, especially when you’re juggling multiple loans, credit cards, and due dates. If you’re struggling to keep up, debt consolidation may be the solution. In 2025, more tools and financial products are available than ever before to help you regain control of your finances. This guide explores the best debt consolidation options and expert strategies to simplify your repayment and reduce financial stress.

What Is Debt Consolidation?

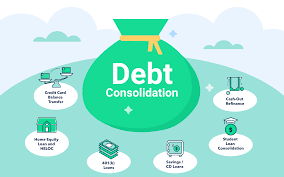

Debt consolidation is the process of combining multiple debts into a single payment—often with a lower interest rate and better terms. Instead of paying different lenders each month, you make one monthly payment to a single creditor or financial institution. This can help you save money on interest, simplify your budget, and improve your credit score over time if managed properly.

Why Consider Debt Consolidation in 2025?

With inflation, rising living costs, and increased interest rates, many people are turning to debt consolidation to ease their financial burdens. In 2025, lenders and fintech platforms are offering more flexible and tech-enabled options. These solutions are often easier to apply for, come with real-time approval, and may even integrate with budgeting apps to help track progress.

Consolidation can also reduce stress by organizing your finances into one predictable monthly payment. It can prevent missed payments, help you avoid penalties, and offer a faster path to becoming debt-free.

Option 1: Personal Debt Consolidation Loans

A personal loan for debt consolidation is one of the most popular choices. You borrow a fixed amount, typically at a lower interest rate than your credit cards, and use that loan to pay off your existing debts. Then, you repay the new loan in monthly installments over a set term.

In 2025, many banks, credit unions, and online lenders offer personal loans with competitive rates. Some even offer same-day funding. This option works well for individuals with good credit, as lower rates are typically reserved for borrowers with higher credit scores.

Option 2: Balance Transfer Credit Cards

If your debt mostly consists of high-interest credit card balances, a balance transfer card might be a smart move. These credit cards offer an introductory 0% APR period—usually lasting between 12 and 21 months. During this time, you can pay off your debt without accruing interest.

In 2025, several issuers are extending 0% APR periods to attract new customers, making this option especially attractive. However, balance transfer cards often come with a 3–5% fee, and if you don’t pay off the balance before the promotional period ends, regular interest rates kick in. It’s best for those with strong repayment discipline and good credit scores.

Option 3: Home Equity Loans or HELOCs

If you own a home, you might qualify for a Home Equity Loan or a Home Equity Line of Credit (HELOC). These options let you borrow against the equity in your property and often offer lower interest rates compared to personal loans and credit cards.

A Home Equity Loan provides a lump sum with fixed payments. A HELOC, on the other hand, works like a credit card with a variable interest rate and flexible borrowing limits. In 2025, digital mortgage platforms and real estate fintech firms are making it easier to apply for home equity products online.

Keep in mind that your home acts as collateral, so you risk foreclosure if you fall behind on payments. This option is better suited for homeowners with significant equity and stable income.

Option 4: Debt Management Plans (DMPs)

A Debt Management Plan is a structured repayment program offered by nonprofit credit counseling agencies. These agencies negotiate with your creditors to reduce interest rates or waive certain fees. Then, you make a single monthly payment to the agency, which distributes the funds to your creditors.

DMPs typically last 3 to 5 years. In 2025, many credit counseling services are available online, offering virtual sessions and digital dashboards to monitor your progress. This option works well for people with multiple unsecured debts who need professional guidance and lower monthly payments.

Option 5: Debt Settlement Services

Debt settlement is a more aggressive approach. It involves negotiating with creditors to accept less than the full amount owed. You typically stop making payments while you save money in a settlement account. Once there’s enough saved, the debt settlement company offers a lump sum to each creditor.

While this can reduce your total debt, it also harms your credit score and involves fees. In 2025, regulations are tighter on these services, and consumers should be cautious. This option is best for those facing serious financial hardship who are considering bankruptcy but want an alternative.

Option 6: 401(k) or Retirement Loans (Use with Caution)

Some people consider borrowing from their 401(k) or retirement accounts to consolidate debt. While this may seem appealing—especially with low or no interest—it comes with major risks. If you leave your job or can’t repay the loan, you could face penalties and taxes.

Financial experts in 2025 continue to advise against using retirement funds unless it’s a last resort. Draining your retirement savings can set back your future and leave you financially vulnerable later in life.

How to Choose the Best Debt Consolidation Option

To find the right strategy, start by listing all your debts, interest rates, and minimum payments. Then, determine your credit score, monthly budget, and how much you can realistically pay toward debt each month.

If you have a good credit score and steady income, a personal loan or balance transfer card might be the best option. If your score is lower or you need more structure, a DMP could help. For homeowners, home equity products may offer low interest, but require careful planning.

Compare interest rates, fees, repayment terms, and potential risks. Use free online calculators to estimate monthly payments and total savings. In 2025, many mobile apps and financial platforms can assist with real-time comparisons and even prequalify you without a hard credit pull.

Tips for Successful Debt Consolidation

Once you consolidate your debt, avoid accumulating new balances. Keep track of your spending, build an emergency fund, and stick to your repayment plan. Set up automatic payments to avoid missing due dates. Some people close old accounts after consolidation to avoid temptation, but keeping them open (with no balance) can help your credit score by improving your credit utilization ratio.

Monitor your credit report regularly and celebrate small wins. Even small improvements in your credit score or debt reduction can boost motivation.

Final Thoughts

Debt consolidation is a powerful tool for gaining control of your finances. In 2025, consumers have more access than ever to smart, digital solutions and flexible lending options. Whether you’re dealing with credit cards, medical bills, or personal loans, consolidating your debt can reduce stress, simplify payments, and help you achieve financial freedom faster.

The key is to choose a method that matches your financial situation and goals. Take the time to research your options, avoid scams, and work with trusted providers. With the right strategy, you can turn your debt into a manageable, structured plan—and move confidently toward a debt-free future.